✅ Tip 2: Copy Trading High Profits: Tips & Risks Explained

🔓 Want access to all 12 copy trading tips?

Log in here for FREE or

create your free account »

Why High Profits Aren't Always Good News

Copy trading high profits can look attractive, but hidden risks are always present. Learn how to manage these risks effectively.

When something seems too good to be true, it usually is. Many high-profit master traders don't survive more than two months because they take excessive risks.

- Extremely high profits often lead to total loss.

- Short-term profits are rarely sustainable.

- Accounts vanish frequently due to liquidation.

Finding the Right Balance in Copy Trading

There’s always a direct connection between your profit (ROI) and potential loss (Drawdown). Higher profits typically mean greater risks.

- Higher profits = Higher potential drawdown.

- Moderate profits offer better long-term sustainability.

- Stability is key: steady growth over short-term spikes.

Ready to earn faster — without doing the work?

Get instant access to the 20 best Bybit Copy traders→ (Pays for itself within 3 days)

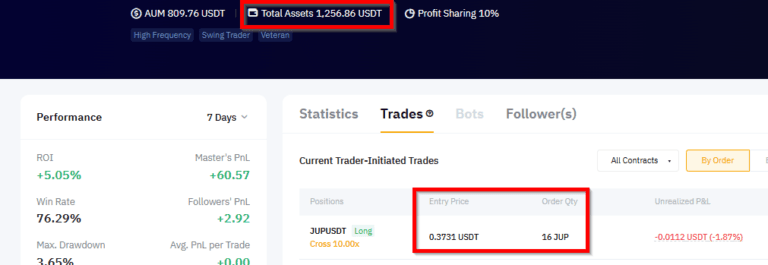

Master Copy trader

Total assets: 1256$

Entry Price: 0.3731

Order Qty: 16

Risk: 0.5%

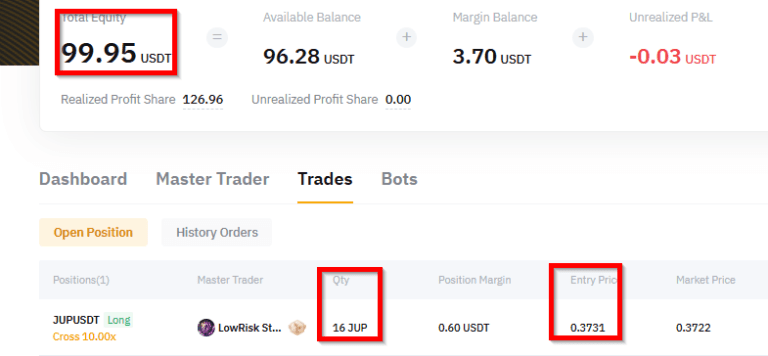

The Copy trade

Total assets: 99.95$

Entry Price: 0.3731

Order Qty: 16

Risk: 5.9%

How to Choose the Right Master Traders

Follow these clear guidelines when selecting traders:

- Look for traders making 80-100% profit in 90 days (stable growth).

- Maximum 50-60% profit in any 30-day period.

- Occasional exceptional months are normal; consistent results are crucial.

Want High-Profit Traders? Follow the Golden Rule

If you still want higher-risk traders in your portfolio, remember:

- Allocate a maximum of 20% of your total budget to these traders.

- Follow previous tips closely to reduce risk exposure.

Maximize Your Success by Diversifying

Diversification reduces risks and boosts long-term success:

- Follow multiple traders simultaneously.

- Identify traders who remain profitable during market downturns.

- Prioritize traders who consistently manage risk effectively.

FAQ Copy Trading

The relationship between ROI (Return on Investment) and drawdown is essential in evaluating a trader's risk-reward balance. A high ROI with a high drawdown indicates a riskier strategy, while a lower ROI with low drawdown suggests more stable performance. Ideally, you want traders with a consistent ROI and limited drawdowns, showing they can grow your capital without exposing you to major losses.

ROI stands for Return on Investment. It measures the percentage gain or loss on an investment relative to its original cost. In copy trading, ROI helps assess a trader's overall profitability. It's calculated by dividing the net profit by the initial investment and multiplying by 100. A positive ROI means the trader is making money, while a negative ROI indicates losses.

Master Traders are experienced and often high-performing traders on copy trading platforms. They allow others to replicate their trades in exchange for a fee or share of profits. It's important to note that not all Master Traders are equally skilled—look at their ROI, risk profile, consistency, and trading history before deciding to follow them.

Liquidation occurs when a trader's position is forcibly closed because their account doesn’t have enough margin to sustain losses. In copy trading, if your linked trader gets liquidated, your position will close too, often resulting in significant losses. Choosing traders with sensible leverage and risk control helps avoid this outcome.

Risk management is crucial because even top traders experience losses. Implementing features like stop-losses, allocating funds across multiple traders, and setting maximum loss limits helps protect your capital. It’s not just about copying successful trades — it's also about minimizing the impact of bad ones.

Copy trading allows users to automatically mirror the trades of expert traders. When the expert trader opens, modifies, or closes a position, the same action is replicated in the follower's account proportionally. This allows beginners or time-restricted users to benefit from the expertise of seasoned traders.

Yes, copy trading can be profitable for beginners when executed correctly. By following top-performing traders and using proper risk management strategies, beginners can benefit from expert insights without needing extensive market knowledge themselves.

High-profit copy trading strategies include following traders with consistent track records, low drawdowns, and well-documented histories. Diversifying across traders and monitoring performance regularly helps maximize gains and reduce risks.

Before copying a trader, examine their ROI, drawdown percentage, win rate, number of followers, open positions, and trading history. Consistency over time is often more valuable than short bursts of profit.

If a copied trader starts underperforming, consider pausing the copy strategy or reallocating your funds to other traders. It's crucial to monitor trader performance regularly and not rely solely on past successes.

Copy trading platforms earn through various models: subscription fees from users, profit-sharing agreements with traders, or spreads/commissions on trades executed via their platform. Some may also charge fees for premium features like advanced analytics.

Yes, copying multiple traders is a recommended strategy to diversify your investments and spread risk. By following traders with different styles or markets, you can create a more balanced and resilient portfolio.

Yes, both Binance and Bybit offer copy trading features. However, the tools, trader rankings, and fee structures may vary between platforms. Be sure to review each platform’s interface and features before deciding where to start.

Why this tip is gold

Consistency beats short-term gains every time. Diversify, control your risks, and follow traders who prioritize stability over temporary high profits.