✅ Tip 1: How to Manage Copy Trading Risk with small budget | GetCopyData

🔓 Want access to all 12 copy trading tips?

Log in here for FREE or

create your free account »

Why You Should Never Copy Trade with a Small Budget

When starting copy trading, beginners often make the mistake of using a small budget, like $50 or $100. However, this can increase the copy trading risk, causing your trades to diverge from the master trader’s

- At first, things seem fine as your master trader is making profits and you’re copying their trades.

- But over time, the market can move against you, and you might end up with losses.

- With a small budget, your trades may not match your master trader’s trades properly.

- This can lead to big differences in how much risk you’re taking, which could be dangerous.

That’s why it’s better to start with a larger budget to avoid these issues and to trade more safely.

Why Copy Trading Risk Can Be a Problem for Small Budgets

Both Bybit and Binance have minimum trade amounts, usually set at $5. This can create problems when you're working with a smaller budget.

- Imagine your master trader has a budget of $1000 and opens a position worth $20

(2% of their portfolio). - If you’re following this trader with a $100 budget, you would ideally want to open a position worth $2.

- But since Bybit and Binance have a minimum trade size of $5, your position ends up being 2.5 times larger than your master trader’s (5% instead of 2%).

- With a $50 budget, your position could even be as high as 10% compared to the master trader’s 2%!

This big difference in position sizes can lead to higher risks, especially when the market goes in the opposite direction.

Ready to earn faster — without doing the work?

Get instant access to the 20 best Bybit Copy traders→ (Pays for itself within 3 days)

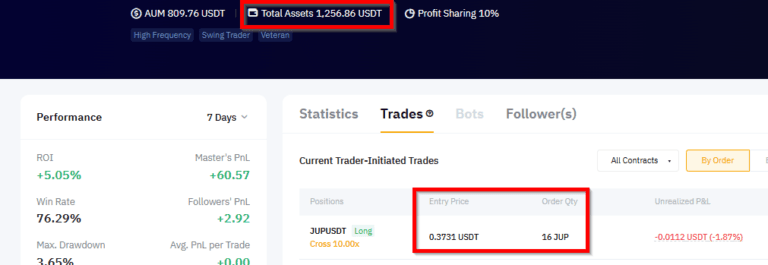

Master Copy trader

Total assets: 1256$

Entry Price: 0.3731

Order Qty: 16

Risk: 0.5%

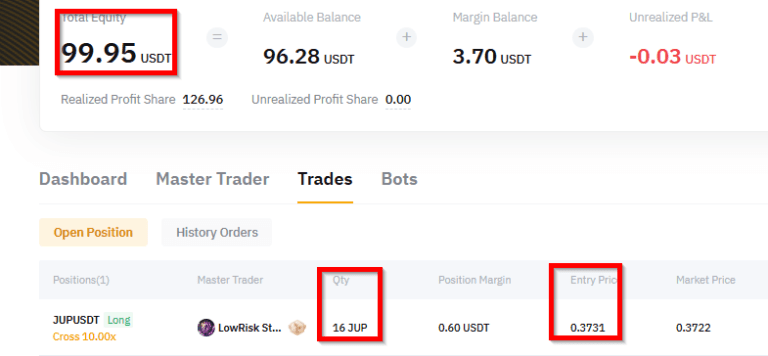

The Copy trade

Total assets: 99.95$

Entry Price: 0.3731

Order Qty: 16

Risk: 5.9%

Here’s How You Can Check:

Example Calculation:

- Master Trader: 16 x 0.3731 = (5.97) / 1256 = 0.5% risk

- Copy Trader: 16 x 0.3731 = (5.97) / 99.95 = 5.9% risk

In this case, Bybit purchased using the minimum value, which means we have effectively purchased 10x more compared to the Master trader!

Master Trader's Trade: Tools > Copy Trading > (Search your master trader) > Trades (top)

Your Copy Trades: Tools > Copy Trading > My Copy Trading > Trades.

Now, you’ll be able to see both your master trader’s trade and your own.

Compare the Positions:

- Take the value of your master trader's last order (Order Quantity x Average Entry).

- Then divide it by the total assets your master trader has or the amount you’ve assigned to this trader in your copy trading budget.

What You Should Look For:

Your risk per trade should be similar to your master trader's risk. If your percentage is much higher than theirs (like in the example above), it means you're not fully invested in their strategy. Ideally, your trade risk should match theirs closely.

If your risk is much higher than your master trader's, you could face problems when they need to add more funds to their position. With a smaller copy trading budget, you won’t be able to add more funds, and your budget will quickly be used up. This can lead to losses and even liquidation!

To avoid this, make sure your risk is aligned with your master trader’s. This will help you reduce unnecessary risks and increase your chances of success in copy trading.

FAQ: Key Copy Trading Terms

Master Trader

A master trader is an experienced trader whose strategies and trades you follow and copy in copy trading. They have a proven track record of making profitable trades.

Risk Per Trade

Risk per trade refers to the percentage of your total budget that you’re willing to risk on a single trade. It helps you determine how much you’re risking relative to your total investment amount.

Position Size

Position size is the amount of money you invest in a specific trade. A smaller position means you risk less, while a larger position means you’re taking on more risk depending on your budget.

Minimum Trade Value

The minimum trade value is the smallest amount you can use to execute a trade on platforms like Bybit or Binance. This can cause issues for beginner traders with small budgets.

Liquidation

Liquidation occurs when your position is automatically closed by the platform because your account doesn’t have enough funds to cover the losses. This often happens with high risks or when you have too small a budget and the market moves against you.

Risk Management

Risk management is the process of managing how much risk you take per trade and handling your overall investments to ensure that you don’t lose everything on a single failed trade.

Why this tip is gold

Always align your risk with your master trader’s to avoid unnecessary losses and maximize long-term success in copy trading.

By matching your trade sizes with your master trader, you reduce overexposure and ensure you're on the path to profitable copy trading. Don't let a small budget or unbalanced trades limit your potential!