My Copy Trading Journey: From Beginner to Succesful Trader

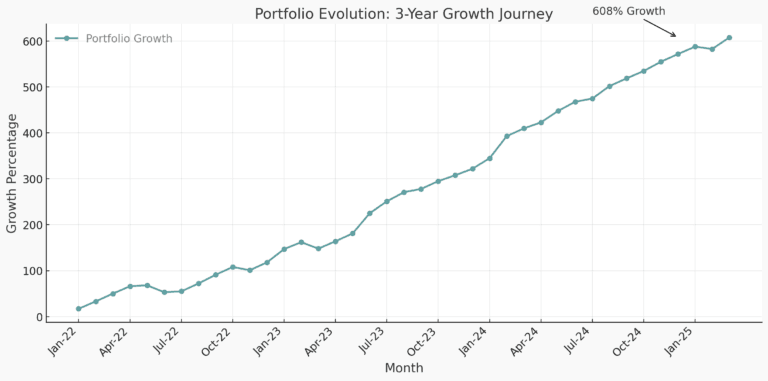

Learn How I Grew My Wallet by 608% in 3 Years!

My Copy Trading Journey: From Losses to 608% Profit in 3 Years

Copy trading changed my entire approach to investing. In this article, I’ll take you through my complete journey—from losing trades to finally growing my wallet by 608% using data-driven copy trading on Bybit and Binance.

📈 Why I Chose Copy Trading

Before discovering copy trading, I spent countless hours trying to understand charts, news, and technical indicators. Despite my efforts, my results were inconsistent and frustrating.

Then I came across the concept of copy trading—automatically copying the trades of expert traders. At first, I was skeptical. But when I found out platforms like Bybit and Binance offered transparent performance data, I gave it a try.

🧠 First Lessons Learned

My early results were mixed. I made the classic beginner mistakes:

- I picked traders with the highest short-term ROI. (See why this is risky)

- I ignored metrics like drawdown or risk ratio.

- I didn’t diversify—I copied just one trader at a time.

This led to some serious drawdowns and even full liquidations. Looking back, I now understand how starting with too little capital and no plan set me back months.

📊 The Data-Driven Shift

After a few months, I took a step back. I started analyzing the performance of over 100 traders. Here’s what I learned:

- Consistent profits matter more than flashy ROI.

- A drawdown under 10% was often a sign of good risk management.

- Traders with lower leverage tended to last longer.

I started tracking metrics weekly and switched to following traders ranked by data—not hype. This shift was crucial to my future success. Here’s how I used historical data to filter out high-risk traders.

💡 My Current Strategy (and Why It Works)

Today, I follow a diversified mix of 3 to 5 traders on Bybit. I use internal dashboards to evaluate them, including:

- 90-day ROI

- Drawdown history

- Number of liquidations

- Account growth trend

I allocate a fixed percentage of my capital to each trader, and I rebalance monthly. The result? My account grew steadily over 3 years, reaching a total return of over +608%.

🚫 Top Mistakes I Made (So You Don’t Have To)

- Starting with tiny amounts—I thought I was being cautious, but small trades made it harder to diversify and didn’t benefit from compounding.

- Not keeping records—I didn’t track who I copied or what results they got. Without data, I couldn’t improve my strategy. It wasn’t until I created my own spreadsheets and tools that progress started.

- Reacting emotionally—I’d copy someone based on one good week, only to see losses pile up the next. Patience is key.

📌 Tips for Anyone Starting Copy Trading

- Don’t chase high ROI blindly—check drawdowns and consistency

- Diversify: never put all your capital behind one trader

- Track results monthly, not daily

- Use data platforms (like GetCopyData) to rank traders based on real numbers

🎯 My Success in Copy Trading

By applying these lessons and consistently tracking data to make informed decisions, I can confidently say that my copy trading has been a success.

And now? I’m taking things to the next level. Instead of manually tracking traders, I’ve started using premium data tools that go beyond 90 days of performance. These tools help identify the top 20 traders across multiple platforms—based on objective, historical insights.

Ready to improve your copy trading? Check out our 12 proven tips or learn more about our data plans to level up your strategy today.

Copy Trading FAQs

Yes, copy trading can be profitable even for beginners, especially when following experienced and data-backed traders. However, it’s important to manage risk and choose reliable traders.

Look for traders with consistent returns, low drawdowns, and a transparent performance history. On our platform, we rank traders based on real data, not hype.