✅ Tip 7: Check Profit Comparisons for Smarter Copy Trading

How to calculate follower ROI

🔓 Want access to all 12 copy trading tips?

Log in here for FREE or

create your free account »

Why this matters

Not every master trader’s success means your success.

Always check if you’re actually getting a fair share of the profits — aim for

at least 50%, ideally 60%+ of the master’s ROI.

Check ROI in 2 minutes

Use the same formula as Bybit and Binance: compare the follower's ROI with the master trader's.

This step is crucial — if the follower's ROI is significantly lower, it's a red flag.

Ideally, the follower's ROI should be at least 50% of the master's.

Check the table below to quickly calculate and compare both ROIs.

ROI = Profit (followers) / Assets (AUM)

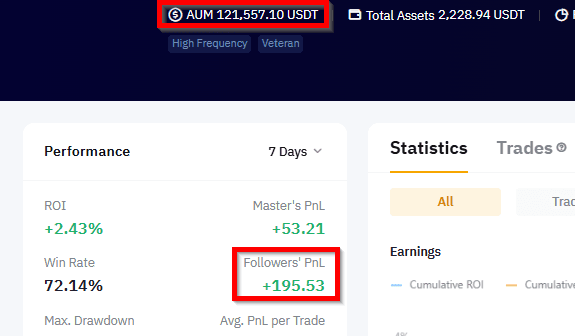

❌ Example 1: Avoid this trader

Master ROI: 2.39%

Follower ROI: 195 ÷ 121,557 = 0.16% (ROI)

→ (Follower ROI = Follower PnL ÷ AUM)

You only receive 7% of the master’s performance

⚠️Too much slippage – don’t follow

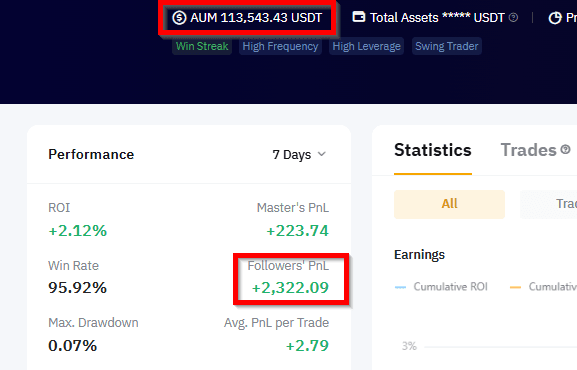

✅ Example 2: Good trader

Master ROI: 2.12%

Follower ROI: 2,322 ÷ 113,543 = 2.04% (ROI)

→ (Follower ROI = Follower PnL ÷ AUM)

You earn 94% of what the master earns

✅ Passes the slippage test – safe to follow

Why these differences happen

Timing – Masters enter/exit trades slightly earlier than followers, especially in volatile markets.

Small amounts – Followers copying with very low amounts may skew the average down. More on that in our tip “Avoid Small Amounts.”

Bonus Tips for Smarter Copying

✔️ Use the 7-day performance window:

AUM (follower capital) can change rapidly, making older ROI stats less reliable.

✔️ Already following someone?

Compare your ROI regularly with the master.

If your returns are way lower, consider switching to a more efficient trader.

FAQ – Copy Trading Profit Comparison

The displayed ROI can be misleading. It often includes theoretical trades or accounts that executed different prices. Always compare a trader's profit with your own trade logs. This way, you’ll avoid performance gaps and better understand the ROI difference in copy trading.

You can export your trade history from your copy trading platform and compare your entry prices to the master account. If the difference is large, it could signal slippage or execution delays. We explain how to track this in detail on this page.

If your ROI is consistently worse, consider switching traders or copy trading platforms. You might be joining trades too late. For better alignment and insights, explore historical trader performance on Tip 8.

Yes. Once you learn how to compare actual vs reported ROI, you can spot which traders give you the most reliable returns. The free copy trading tips page shows how to use this strategy effectively.

A good ROI in copy trading depends on risk, strategy, and timeframe. Generally, anything above 5% per week (≈15%-20% monthly) with low drawdown is considered solid. Focus on sustainable returns rather than flashy short-term gains.

Why this tip is gold

Most copy traders never check this. They assume that if the master is green, they must be too.

But in reality, the gap can be huge – and cost you money.

Now you know how to measure this in just 2 minutes – and stop wasting time on underperforming trades.